Iran has become increasingly reliant on China to survive existential crises, including diplomatic isolation, regional tensions and a rocky economy. In March 2023, China—Iran’s largest trade partner—brokered an agreement between Iran and Saudi Arabia to restore diplomatic ties seven years after severing relations. The deal reflected Beijing’s growing influence and interest in Iran. “China is trying to translate its economic power into political power,” Nasser Hadian, a professor of political science at the University of Tehran, told The Iran Primer. “Iran is very important as a source of energy, but also as a provider of the security in the region. In the future, Iran and China are going to be very closely interdependent.”

Related Material: Iran and Saudi Arabia Restore Ties

Iran’s ties with China—part of a broader shift toward the East—have strengthened particularly since the United States withdrew from the nuclear deal and reimposed sanctions on Tehran in 2018. China reportedly continued importing Iranian oil despite U.S. sanctions. In 2021, the two countries signed a 25-year strategic agreement to strengthen economic and security cooperation.

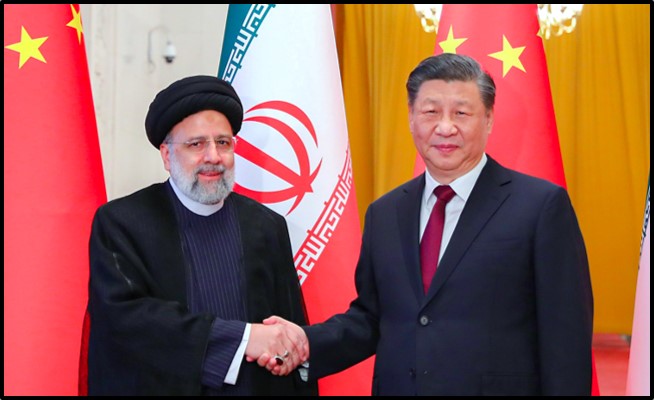

In 2023, tensions escalated between the United States and both Iran and China, albeit over disparate flashpoints. Iran and China are “friends in difficult situations,” President Ebrahim Raisi wrote in an op-ed for the People’s Daily, the Communist Party newspaper, before traveling to Beijing in February. The multifaceted relationship was reflected in the following areas:

- Economy: For the 10th consecutive year, China was Iran’s largest trade partner. Iran’s trade with China reached almost $16 billion in 2022, up seven percent from 2021. China’s crude oil imports from Iran reportedly set a new record in December 2022. Iran was also on track to formally join the Shanghai Cooperation Organization, an economic and security bloc led by China and Russia, by April 2023.

- Security: President Raisi hosted Chinese Defense Minister Wei Fenghe in April 2022 to improve strategic defense cooperation. The two countries reportedly agreed to collaborate on military strategy and engage in joint military drills and training. In March 2023, Iran, China, and Russia conducted a five-day naval drill in the Gulf of Oman. Despite growing defense ties, however, Iran did not purchase Chinese arms between 2020 and 2022.

- Diplomacy: President Raisi traveled to Beijing in February 2023, the first state visit by an Iranian president in more than two decades. The two countries signed 20 agreements—including on trade, transportation, information technology, tourism, agriculture, and crisis response—that could be worth billions of dollars. One month later, Beijing brokered a deal between Iran and Saudi Arabia to restore diplomatic relations and reopen embassies.

Longstanding Ties

Trade between the two countries dates back to at least 200 B.C. Their cultural and economic ties were cultivated along Asia’s ancient Silk Road. In the 13th century, they were both briefly consumed by the Mongol Empire. Both countries, ruled by successive dynasties for more than two millennia, witnessed revolutions in the 20th century—China in 1949, Iran in 1979—that transformed Asia and challenged the international order dominated by the West.

The break in diplomatic relations between Iran and the United States in 1980, after the student seizure of the U.S. Embassy in Tehran, created new opportunities for Beijing and Tehran to again deepen ties, both economically and strategically. Before the revolution, Iran’s oil exports had gone primarily to Western Europe and the United States in the 1970s, when oil prices quadrupled after the 1973 Middle East War. In 1974, Iran’s production peaked at a record 6 million barrels per day (bpd). It all changed after the shah was ousted.

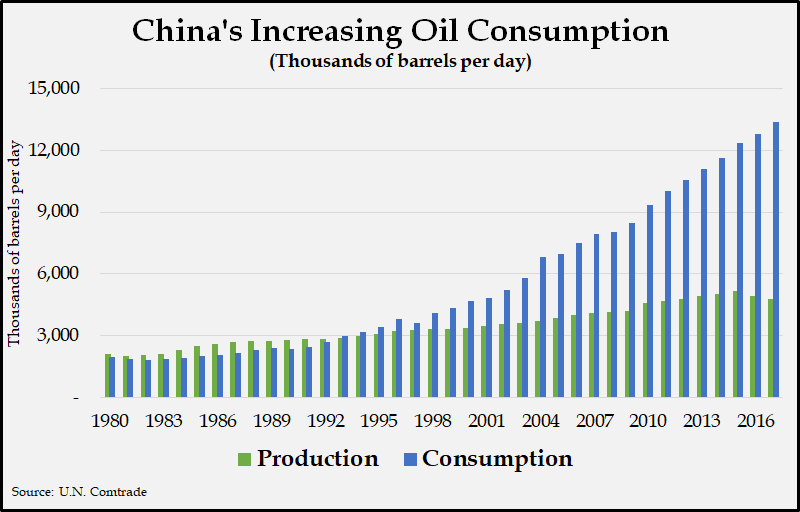

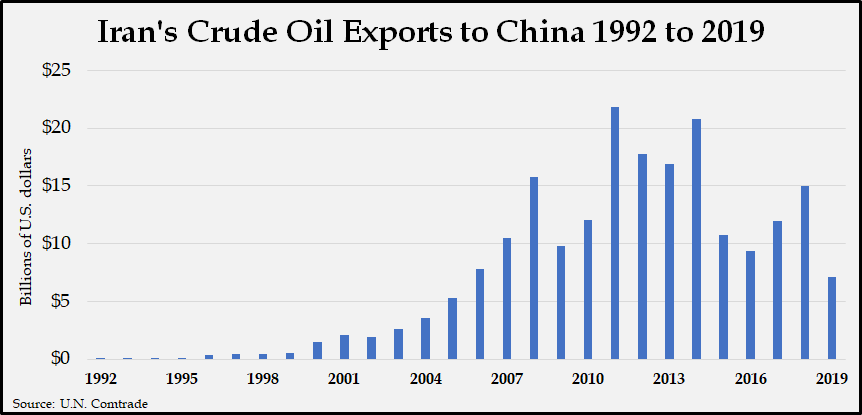

For Iran, China became an ally to counter U.S. influence along its borders in the Middle East and South Asia. For China, Iran became an important source of energy to serve its burgeoning industries and rapidly expanding population. Iran was also a route to gain influence in the Persian Gulf. Over four decades, their relationship evolved through three phases: military cooperation during the Iran-Iraq War in the 1980s, energy cooperation in the 1990s as China rapidly industrialized, and oil trade defying sanctions.

Phase 1: Iran-Iraq War

The Iran-Iraq War, between 1980 and 1988, was a key impetus in deepening ties. Western countries, which had long sold warplanes and military equipment to the shah, imposed arms embargoes on Tehran. Iran turned to non-Western countries--such as China, North Korea and Russia--to restock its military.

The war coincided with Chinese leader Deng Xiaoping’s economic reforms, which had been launched in December 1978. He called for increased arms sales to Third World countries to generate foreign currency. From 1979 to 1985, Beijing sold $6.3 billion worth of weaponry worldwide; 95 percent of its sales were exports to the Middle East and South Asia. China became the largest source of arms to the Islamic Republic during its war with Iraq. In 1983, Beijing sold Tehran $444 million worth of military equipment.

China provided Iran with 22 percent of its military equipment, including anti-ship missiles, surface-to-air missiles, artillery pieces, tanks, and radars, as well as small arms and ammunition. Chinese equipment allowed Iran to quickly replenish its losses and continue the war indefinitely. By the end of the eight-year war, China had sold Iran weaponry worth $2 billion.

Phase 2: Chinese Industrialization

After the war ended in 1988, trade ties shifted from arms sales to oil and energy. In 1989, China sold Iran $68 million in arms—down 89 percent from $612 million in 1987. Since then, Iran has mainly sold China petroleum products; in turn, it has mainly purchased consumer goods such as clothing, vehicles, electronics, chemicals, household appliances, and telecommunications equipment from China.

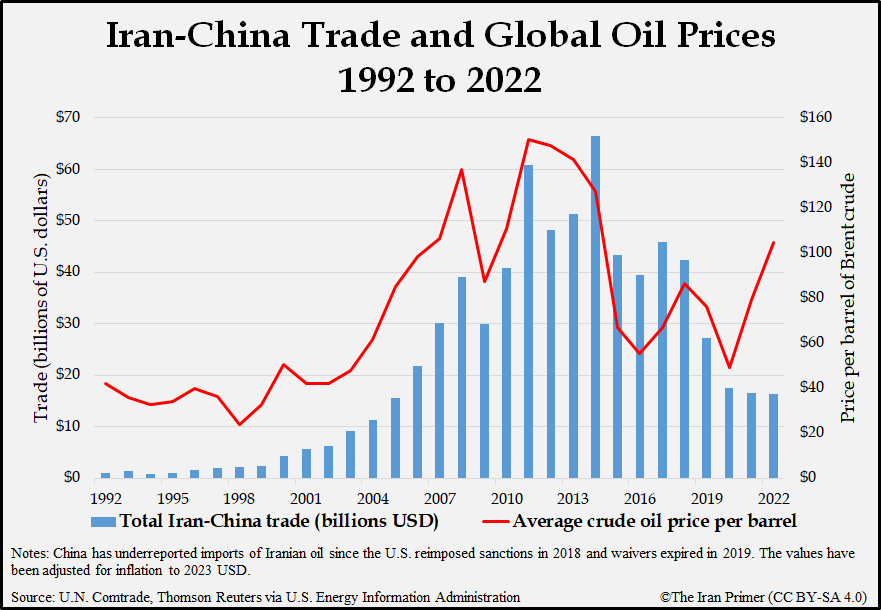

In the early 1990s, China underwent a period of rapid industrialization and economic growth. In 1993, it transitioned from an oil exporter to a net oil importer to meet growing energy needs. In 1990, China had consumed 2.3 million bpd. By 2000, it needed 4.7 million bpd. Beijing increasingly turned to markets in the Middle East and Southeast Asia—especially untapped markets where it did not have to compete for contracts with Western nations—to meet its fuel requirements. Iran had plentiful natural resources and a market from which the West had largely withdrawn after 1979. Bilateral trade between the two countries significantly increased from $400 million in 1990 to $1 billion in 1997, largely due to increased energy trade. Between 2000 and 2012, China hovered between 9 percent and 14 percent of its oil imports from Iran.

But Iran’s oil sector grew more reliant on China as a trading partner after the United States and the United Nations imposed sanctions in 2010. Only 5 percent of Iran’s total oil exports went to China in 2000; by 2011 Iran sold China 25 percent of its oil. China also became a crucial investor in Iran’s oil and gas industry as U.S. and international sanctions reduced Iran’s access to foreign capital and the technology needed to develop its deteriorating energy sector. By 2019, China consumed 12.8 million bpd--or 13 percent of total global consumption.

Phase 3: Sanctions Era

In 2010, the United States and United Nations imposed major sanctions on Iran’s nuclear and energy sectors because of concerns over its ability to build a bomb. China tried to navigate between maintaining trade with Iran and complying with U.S. and U.N. restrictions. Iran, in turn, needed China’s investment to aid its isolated economy. In 2010, unemployment officially reached 15 percent—with higher unofficial estimates--as the population was growing by nearly one million annually.

In October 2010, China informally instructed companies to curtail development projects in Iran to avoid sanctions on its major energy firms. The China National Petroleum Corporation (CNPC) delayed a drilling exploration project at the South Pars oil field; Iran countered by demanding that China speed up development or lose the contract. Tehran ultimately suspended the contract in October 2011. China’s Sinopec company also halted the second phase of a 2007 contract to develop the Yadavaran oil field.

Yet Beijing continued to import large quantities of Iranian oil despite sanctions. In 2011, China’s Sinopec company signed and completed a deal to import an additional 90,000 bpd of Iranian condensate, a super light crude oil. Iran discreetly transported shipments to China and other Asian countries by renaming and reflagging its vessels. By July 2012, Iran was using more than 60 tankers—roughly two-thirds of its tanker fleet--to store up to 40 million barrels of crude oil at sea while it located buyers.

Under growing economic pressure, Iran negotiated with the world’s six major powers between 2013 and 2015 on limits to its nuclear program in exchange for sanctions relief. The subsequent 2015 JCPOA (or Joint Comprehensive Plan of Action) led to the lifting of U.S., European and U.N. sanctions in January 2016. By September 2016, Iran exported 1.7 million bpd; about 41 percent—some 700,000 bpd--went to China.

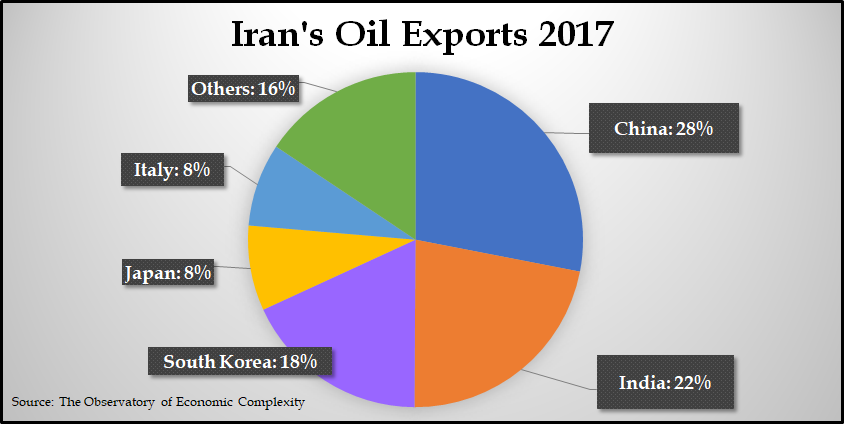

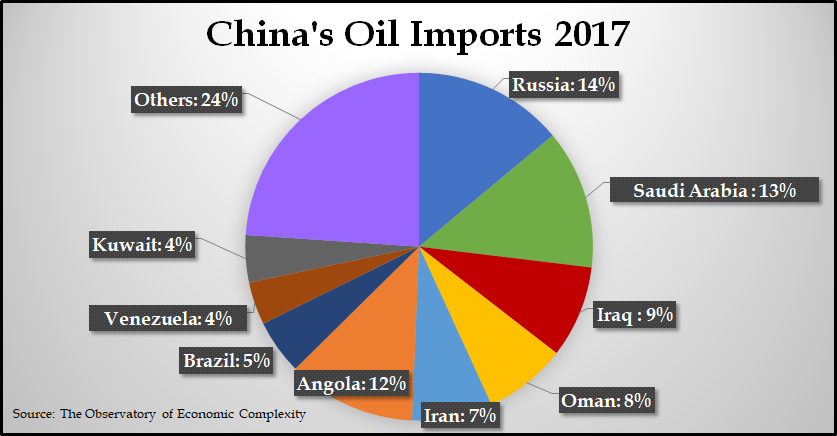

The following two graphs illustrate Iran’s oil exports and China’s sources of oil in 2017 during the second year of the nuclear deal.

In May 2018, the Trump Administration abandoned the nuclear deal. At the time, Iran was exporting 2.7 million barrels per day—775,000 bpd to China, or 29 percent of total sales. The U.S. move—and the threat of new sanctions--had an immediate impact. Iran’s total oil exports halved in four months as Tehran struggled to find buyers. By September 2018, the Islamic Republic’s total exports plummeted to 1.3 million bpd. China imported 333,300 bpd from Iran, down to less than half of what it bought in May. Yet it still accounted for roughly a quarter of Iran’s sales-- 26 percent--as other buyers cut back. “We should look East, not West,” the Supreme Leader, Ayatollah Ali Khamenei, said in October. “Pinning our hope on the West or Europe would belittle us as we would beg them for favor and they would do nothing.”

In November 2018, the United States formally reimposed sanctions and sought to reduce Iran’s exports to zero. It also threatened to sanction any country or foreign company that continued trading with Iran. In March 2019, 76 percent of Iran’s total oil exports went to Asia. The majority went to China, South Korea, India, Turkey, and Japan. China was granted a temporary six-month waiver. It was allowed to buy 360,000 bpd of Iranian oil without penalty.

In May 2019, the U.S. waivers expired. China defiantly continued to import Iranian crude oil, although sanctions did have an impact on bilateral trade. Chinese companies appeared more hesitant to do business with Iran for fear of financial penalties. In June 2019, China imported only 210,000 bpd of Iranian crude—the lowest in nearly a decade and 60 percent below imports from Iran in June 2018.

The expiration of waivers had a swift effect; Iran’s economy suffered. By July 2019, Iran’s total oil exports fell to as low as 100,000 bpd, down from around 400,000 bpd in June. Even China changed its buying patterns. It doubled its oil imports from Saudi Arabia from the previous year. Beijing imported 1.8 million bpd from the kingdom in July, up from 921,811 bpd in August 2018.

Tehran became creative to circumvent U.S. sanctions. In January 2019, Iran offered discounts to Asian buyers. It cut the price of Iranian light crude by $1 per barrel, approximately 30 cents a barrel lower than Saudi Arabia’s light crude. It was the largest discount Iran had offered against Saudi prices in more than a decade.

Circumventing Sanctions

To beat sanctions and sell its oil, Iran began to engage in subterfuge and financial trickery. Ships carrying Iranian oil became difficult to trace, as some tankers reportedly turned off identification systems used by the International Maritime Organization to track ship movements. Some Iranian ships also stopped reporting their positions when they neared a buyer’s port. Other tankers transporting Iranian crude changed their names and identification numbers at sea to avoid detection.

After the U.S. reimposed sanctions in 2018, Iran reportedly stockpiled oil as bonded storage in the Chinese ports of Jinzhou, Huizhou, and Tianjin. Between May 2 and August 3, 2019, six Iranian tankers unloaded unspecified amounts of crude oil in Tianjin and Jinzhou, The New York Times reported. The oil in bonded storage did not go through local customs or register in China’s import data. Most of it was still owned by Tehran and, therefore, did not technically breach U.S. sanctions.

Keeping oil in bonded storage allowed Tehran time to find a buyer in Asia without payment of tariffs or other duties. This practice also allowed Tehran to free up its tanker fleet by reducing storage at sea while it found buyers. The crude inventory at Jinzhou reportedly almost doubled—from 3.2 million barrels to 6 million barrels—over six weeks between mid-June and the end of July, according to the data provider Refinitiv. Analysts predicted that global oil price would decrease if millions of barrels of stored Iranian crude entered the market.

By 2021, Iran's oil shipments to China had returned to pre-sanctions levels. Iran shipped more than half a million barrels of crude oil per day to China between November 2020 and March 2021, Reuters reported. The shipments accounted for five percent of China's oil imports. Iran appeared to use third party intermediaries in Oman, Malaysia and the United Arab Emirates to mask exports to China.

U.S. Targeted Sanctions

U.S. sanctions on Tehran are unilateral; Iran technically can still sell its oil to other countries. The United States, however, has intimidated countries —including major powers that brokered the 2015 accord—not to buy from Iran, or they would face similar sanctions too.

The United States took punitive measures on China after it defied U.S. sanctions. On July 22, Washington announced sanctions against the Zhuhai Zhenrong Co., a state-run energy company that “knowingly engaged in a significant transaction for the purchase or acquisition of crude oil from Iran,” according to State Department. The sanctions were the first by the Trump administration against a Chinese company for buying Iranian oil. The administration also targeted an “oil-for-terror” network that smuggled oil to Syria and China to financially benefit Iran’s Revolutionary Guards.

In July 2019, Beijing condemned U.S. sanctions on Chinese companies as “long-arm jurisdiction” and vowed to “firmly safeguard the legitimate rights and interests of its enterprises.” Iran appealed to its allies to continue buying Tehran’s oil despite U.S. pressure. “Even though we are aware that friendly countries such as China are facing some restrictions, we expect them to be more active in buying Iranian oil,” Vice President Eshaq Jahangiri told a visiting senior Chinese diplomat on July 29.

In September 2019, U.S. Treasury announced additional sanctions on five Chinese companies and six Chinese nationals accused of importing oil from Iran. The United States designated the China Concord Petroleum Co. Ltd., and two units of a major Chinese shipping company, Cosco Shipping Tanker (Dalian) Co. Ltd. and Cosco Shipping Tanker (Dalian) Seaman and Ship Management Co. Ltd. Washington also sanctioned the companies’ top executives. “We are telling China, and all nations: know that we will sanction every violation,” said U.S. Secretary of State Mike Pompeo during a speech at the United Against Nuclear Iran Summit.

China condemned the designation and called on the United States to reverse the sanctions. Washington “disregards the legitimate rights and interests of all parties and wields the stick of sanctions at will. It tramples on the basic norms governing international relations,” said Chinese foreign ministry spokesman Geng Shuang.

Phase 4: New Iran-China Partnership Plan

Longstanding trade relations between Iran and China deepened after the United States reimposed punitive economic sanctions on the Islamic Republic in November 2018. Chinese State Councilor Wang Yi called the two countries “comprehensive strategic partners” during a visit by Iranian Foreign Minister Mohammad Javad Zarif in August 2019.

China and Iran signed a 25-year strategic partnership agreement in March 2021. “China is a friend for hard times,” Zarif said after the signing. The Foreign Ministry fact sheet emphasized that the partnership was not a formal treaty and contained no specific commitments on investment or security. It also noted that China’s military was not granted permission to enter Iran or to establish bases.

Yet Iran’s partnership with China was still modest compared to Beijing’s engagement with Tehran's regional rivals, notably Saudi Arabia and the United Arab Emirates. China “has proven reluctant to deepen its economic commitment to Iran given the constraints of the domestic market, U.S. sanctions, and regional tensions which introduce steeper tradeoffs for any Chinese investments,” according to study by Lucille Greer and Esfandyar Batmanghelidj in 2020.

The 2021 negotiations between Iran and China built on the Comprehensive Strategic Partnership, which was signed in January 2016. The 2021 pact did not create a new alliance or change the balance of power in the Middle East overnight. The following are excerpts from the 2020 draft agreement:

Mission: Taking into account the tremendous capacities at hand for bilateral cooperation within the framework of the present document, the two parties will cooperate to achieve the following goals:

- Expansion of bilateral trade and economic ties

- Effective interaction between public and private-sector institutions as well as free and special economic zones

- Improvement of efficiency in such sectors as the economy, technology and tourism

- Strategic partnership in different economic fields

- constant and effective review of the status of the joint economic cooperation with the aim of removing hurdles and tackling challenges

- Coordination and support for one another’s positions at international bodies and regional organizations

- A strengthened enforcement of the laws in bilateral security cooperation including the fight against terrorism

- Cooperation in other fields

Cooperation Grounds: To expand comprehensive cooperation, the two parties will work together within the framework outlined in Appendix 2. Some of the key areas are as follows:

- Energy, including crude oil (production, transfer, refining and secure delivery), petrochemicals, renewable energies, civilian nuclear energy

- Highways, railroads and maritime connections with an increasing Iranian role in the Belt and Road Initiative

- High-standard banking relations, with an emphasis on the use of national currencies along with an assertive fight against money laundering and financial provision for terrorism and organized crime

- Cooperation in tourism, scientific-academic fields and technology, exchange of experience in human force training, eradication of poverty and improvement of public livelihood in underdeveloped areas

Iran-Saudi Rapprochement

In March 2023, China brokered an agreement between Iran and Saudi Arabia to restore diplomatic ties. Tehran and Riyadh agreed to reopen embassies by May 2023. They also sought to implement a 2001 security cooperation agreement as well as a broader 1998 pact to enhance economic cooperation. The Islamic Republic and the Gulf Kingdom affirmed their respect for the “sovereignty of states” and “non-interference in internal affairs.” The deal marked a significant de-escalation of tensions. The following is the statement on the resumption of ties:

In response to the noble initiative of His Excellency President Xi Jinping, President of the People’s Republic of China, of China’s support for developing good neighborly relations between the Kingdom of Saudi Arabia and the Islamic Republic of Iran;

And based on the agreement between His Excellency President Xi Jinping and the leaderships in the Kingdom of Saudi Arabia, and the Islamic Republic of Iran, whereby the People’s Republic of China would host and sponsor talks between the Kingdom of Saudi Arabia and the Islamic Republic of Iran.

Proceeding from their shared desire to resolve the disagreements between them through dialogue and diplomacy, and in light of their brotherly ties;

Proceeding from their shared desire to resolve the disagreements between them through dialogue and diplomacy, and in light of their brotherly ties;

Adhering to the principles and objectives of Charters of the United Nations and the Organization of Islamic Cooperation (OIC), and International conventions and norms;

The delegations from the two countries held talks during the period 6-10 March 2023 in Beijing - the delegation of the Kingdom of Saudi Arabia headed by His Excellency Dr. Musaad bin Mohammed Al-Aiban, Minister of State, Member of the Council of Ministers, and National Security Advisor, and the delegation of the Islamic Republic of Iran headed by His Excellency Admiral Ali Shamkhani, Secretary of the Supreme National Security Council of the Islamic Republic of Iran.

The Saudi and Iranian sides expressed their appreciation and gratitude to the Republic of Iraq and the Sultanate of Oman for hosting rounds of dialogue that took place between both sides during the years 2021-2022. The two sides also expressed their appreciation and gratitude to the leadership and government of the People’s Republic of China for hosting and sponsoring the talks, and the efforts it placed towards its success.

The three countries announce that an agreement has been reached between the Kingdom of Saudi Arabia and the Islamic Republic of Iran, that includes an agreement to resume diplomatic relations between them and re-open their embassies and missions within a period not exceeding two months, and the agreement includes their affirmation of the respect for the sovereignty of states and the non-interference in internal affairs of states. They also agreed that the ministers of foreign affairs of both countries shall meet to implement this, arrange for the return of their ambassadors, and discuss means of enhancing bilateral relations. They also agreed to implement the Security Cooperation Agreement between them, which was signed on 22/1/1422 (H), corresponding to 17/4/2001, and the General Agreement for Cooperation in the Fields of Economy, Trade, Investment, Technology, Science, Culture, Sports, and Youth, which was signed on 2/2/1419 (H), corresponding to 27/5/1998.

The three countries expressed their keenness to exert all efforts towards enhancing regional and international peace and security.

Issued in Beijing on 10 March 2023.

For the Islamic Republic of Iran

Ali Shamkhani

For the Kingdom of Saudi Arabia

Musaad bin Mohammed Al-Aiban

Minister of State, Member of the Council of Ministers, and National Security Advisor

For the People’s Republic of China

Wang Yi

Member of the Political Bureau of the Communist Party of China (CPC) Central Committee and Director of the Foreign Affairs Commission of the CPC Central Committee

Timeline of Iran-China Economic Relations

1974

China first imported oil from Iran.

1979 Revolution

1983

January: China and Iran signed a $500 million trade pact that increased bilateral trade by 150 percent. The package provided Iran with military supplies or civilian equipment that could be converted into military use, such as jeeps and trucks. Tehran became China’s top trading partner in the Middle East. In the early 1980s, the majority of China’s trade with Iran supported the Iranian war effort against Iraq.

1985

March 3: Iran and China established the Joint Committee on Cooperation of Economy, Trade, Science and Technology to collaborate on energy, machinery, transportation, building material, mining, chemicals, and nonferrous metal.

1992-1998: Bilateral trade hovered between $437 million and $1.2 billion. During this period, energy cooperation between the two countries steadily increased as China entered a period of rapid industrialization and population growth.

1993

December: Beijing became a net importer of oil after domestic consumption rates exceeded production. In 1993, China produced 2.90 million bpd and consumed 2.99 million bpd. Rapid industrialization in the 1990s led China to increase its oil consumption from 2.33 million bpd in 1990 to 4.69 million bpd by 2000. China gradually started buying oil from untapped markets in the Middle East and Southeast Asia.

1996

August 5: The Clinton administration passed the Iran-Libya Sanctions Act that imposed tough penalties on companies found investing more than $20 million a year in Iran’s oil and gas industry. The sanctions had modest short-term effects on Iran’s economy. Contracts in Iranian oil and gas fields were delayed, and many foreign companies deferred bidding on new investments. The National Iranian Oil Company (NIOC) had to render greater incentives to negotiate term contracts for supplies formerly committed to U.S. companies.

September: China signed a comprehensive military contract to sell combat aircraft, warships, a variety of armored vehicles, missile and electronic equipment, and military training to Iran. This deal was eventually halted when Beijing agreed to stop selling missiles to Tehran after U.S. pressure.

1997

January: China signed an agreement for oil and gas exploration in Iran. It was Beijing’s first investment in Iran’s domestic oil and gas industry. The deal established multi-billion dollar development projects in the South Pars gas field and Azadegan oil field.

October: Chinese President Jian Zemin assured the United States that China would not transfer additional anti-ship cruise missiles or technology to Iran, nor aid its domestic production program.

2000

January: The NIOC signed an $85 million contract with the China National Petroleum Corporation (CNPC) to drill 19 new oil wells in southern Iran.

June 22-26: President Mohammad Khatami traveled to China for a state visit to reinforce economic, political, and military relations between the two countries. Khatami met with Chinese President Jiang Zemin. Tehran and Beijing signed agreements on energy, mining, and tourism. Both presidents pledged to support stronger ties and cooperation, including in the energy, transportation, communication, technology, and baking sectors. Khatami traveled to several cities and regions, including Beijing, Xinjiang, and Hong Kong.

2004

March 18: Tehran reached a $20 billion agreement with China’s state-owned Zhuhai Zhenrong Corporation to purchase over 110 million tons of liquefied natural gas (LNG) from Iran over a 25 year period. It was, at the time, the world’s single largest purchase of natural gas. China had focused on moving away from burning coal to using cleaner natural gas for its domestic energy needs. Chinese companies rushed to purchase Iran’s large gas reserves—15 percent of the world’s total supply—to profit off Beijing’s growing energy needs.

October: Iran and China agreed to an additional $100 billion deal to add 250 million tons of LNG to China’s domestic supply over a 25 year period. Sinopec signed the deal to develop the Yadavaran oil field in 2006. Sinopec halted the second phase of project in May 2019 while two countries reopened contract negotiations.

2007

December 9: China’s Sinopec signed a $2 billion deal to develop 137 wells at Yadavaran oil field in western Iran. The project had two phases, the first over four years to produce 85,000 barrels per day and the second over the following three years for an additional 100,000 bpd.

2008-2009: Bilateral trade fell from $27.8 billion in 2008 to $21.2 billion in 2009. Global trade generally decreased in 2009 due to fallout from the global economic crisis as global demand decreased.

2009

2009-2011: Bilateral trade significantly increased from $21.2 billion in 2009 to $45.10 billion in 2011. Tightened sanctions increased Iran’s reliance on Chinese imports as Western firms withdrew from Iran’s oil and gas industry. Beijing, as a result, surpassed the European Union as the top buyer of Iranian oil.

January 14: NIOC and CNPC signed a 12-year, $1.76 billion contract to develop the North Azadegan oil field in western Iran. The agreement was based on a buyback plan in which CNPC would develop the field then hand over operations to NIOC and receive payment in oil and gas production until the contract is paid off. Crude output capacity was expected to reach 75,000 bpd in the first 48 months of development. In 2016, CNPC began production at the field, which pumped an estimated 80,000 bpd.

March 9: NIOC opened an office in Beijing to attract investment in Tehran’s energy sector.

June 10: CNPC signed a $4.7 billion contract with NIOC to develop Iran’s South Pars gas field, the largest natural gas field in the Middle East.

November 21: Iran opened its first foreign commerce center in Shanghai to streamline joint investment projects between Iranian and Chinese companies.

December: China overtook the European Union as Iran’s largest trading partner after bilateral trade soared to $36.5 billion, up from $14.4 billion just three years before. Crude oil accounted for approximately 80 percent of total Iranian exports to China.

2010

June 9: The U.N. Security Council adopted Resolution 1929 which tightened proliferation-related sanctions on Iran. It banned Tehran from testing missiles capable of carrying nuclear warheads and imposed an embargo on the transfer of major weapons systems to Iran.

June 24: The United States adopted the Comprehensive Iran Sanctions, Accountability, and Divestment Act which targeted firms investing in Iran’s energy sector or selling refined petroleum to Tehran. It also imposed sanctions on foreign banks conducting business with Iran.

October: The Chinese government reportedly instructed companies to curtail energy development projects in Iran after U.S. sanctions and an agreement with the Obama administration to not undertake future Iranian investment projects. The United States, in return, agreed not to sanction prior Chinese investments.

2011

2011-2012: Bilateral relations decreased from $45.1 billion in 2011 to $36.5 billion in 2012. Many Chinese companies pulled out of contracts due to U.S., U.N., and E.U. sanctions on Iran.

September: CNPC delayed a drilling exploration project at the South Pars oil field, leading to warnings from Tehran to speed up development or lose the contract.

China’s Sinopec company halted the second phase of a 2007 development contract at the Yadavaran oil field after pressure from the United States.

China’s Sinopec company signed a deal with Iran to import an additional 90,000 bpd of condensate. China continued to import Iranian oil despite a decrease in Chinese energy investment projects in Iran due to the threat of U.S. sanctions.

2012

January: The European Union adopted a set of targeted sanctions that banned the import, purchase, and transport of Iranian crude oil and petroleum projects. It also agreed to freeze the assets of Iran’s central bank in the European Union. E.U. countries imported 20 percent of Iran’s oil at the time.

2013

2013-2014: Bilateral trade increased from $39.4 billion in 2013 to $51.8 billion in 2014 due to U.S. sanctions waivers, which increased Chinese oil imports.

November 24: Iran and six world powers – China, Britain, France, Germany, Russia and the United States – signed a deal in Geneva that released $4.2 billion in Iranian oil sales from frozen accounts. Tehran, in return, committed to curbing its nuclear program. The agreement limited Iran’s oil exports to 1 million bpd.

November 29: The United States granted a six-month sanctions waiver to China, India, South Korea and other countries in exchange for their commitment to reduce purchases of Iranian oil.

2014-2015: Bilateral trade decreased from $51.8 billion in 2014 to $31.2 billion in 2016. The drop was the result of a sharp decrease in global oil prices.

2015

July 14: Iran and the six world powers known collectively as the P5+1 reached a landmark deal in which Iran agreed to curb its nuclear program and provide access to inspectors in exchange for sanctions relief. The agreement, known formally as the Joint Comprehensive Plan of Action, went into implementation in January 2016.

2018

May 8: President Trump announced the U.S. withdrawal from the JCPOA and reimposition of sanctions on Iran. Britain, France and Germany moved to salvage the accord. Iran stated its intent to continue with the deal if its economic benefits could be guaranteed. Both China and Russia said they intended to observe the JCPOA and continue to trade with Iran.

November 5: The Trump administration granted temporary waivers to China to import 360,000 bpd of Iranian oil, half of the daily average since January 2016. Beijing was allowed to continue nonproliferation projects at Iranian nuclear facilities.

December 12: CNPC suspended its operations at Iran’s South Pars gas field after pressure from the United States.

2019

January: China’s Sinopec company offered Tehran a $3 billion investment plan to further develop the Yadavaran oil field.

May 2: The Trump administration let sanctions waivers expire in an attempt to “bring Iran’s oil exports to zero.” The waivers had allowed China and seven other countries to continue importing Iranian oil despite U.S. sanctions.

September 11: The Iranian armed forces chief of staff traveled to China for the first time in 40 years. Maj. Gen. Mohammad Bagheri held meetings with senior Chinese military and political officials to discuss security cooperation between the two countries. At the end of the visit, Bagheri announced that a joint naval drill with China would be held in the Gulf of Oman. He did not specify a timeline.

October 6: Tehran announced that China's Sinopec pulled out of a $5 billion deal to develop the South Pars oil field. France’s Total SA previously withdrew from the contract in 2018 after the reimposition of U.S. sanctions on Iran’s oil and gas industry. Oil minister Bijan Zangeneh said Petropars, a domestic company, would take over the contract.

October 21: China's special envoy to the Middle East, Zhai Jun, visited Iran with a delegation to discuss regional developments. Iranian officials called on Beijing to play a more prominent role in the Middle East and highlighted the achievements of Iran, Syria and Lebanon’s Hezbollah in altering the balance of power in the region.

December 1: Iran and China held a joint meeting in Beijing to discuss the JCPOA. Iranian Deputy Foreign Minister for Political Affairs Abbas Aragchi and Chinese Vice Foreign Minister Ma Zhaoxu attended the meeting and stressed the need for closer economic ties between the two countries. “New methods have been found, and we are returning to a stable economic condition in our relations with China, but we need to remove obstacles and upgrade the level of mutual economic ties,” said Aragchi.

2020

June: The “Final Draft of Iran-Strategic Partnership,” a draft of a 25-year agreement with China, circulated on Iranian social media. The 18-page document, which appeared to be leaked, stoked fears among Iran’s public and politicians that China was deepening relations with Iran through secret deals on oil, communications technology, and military ties.

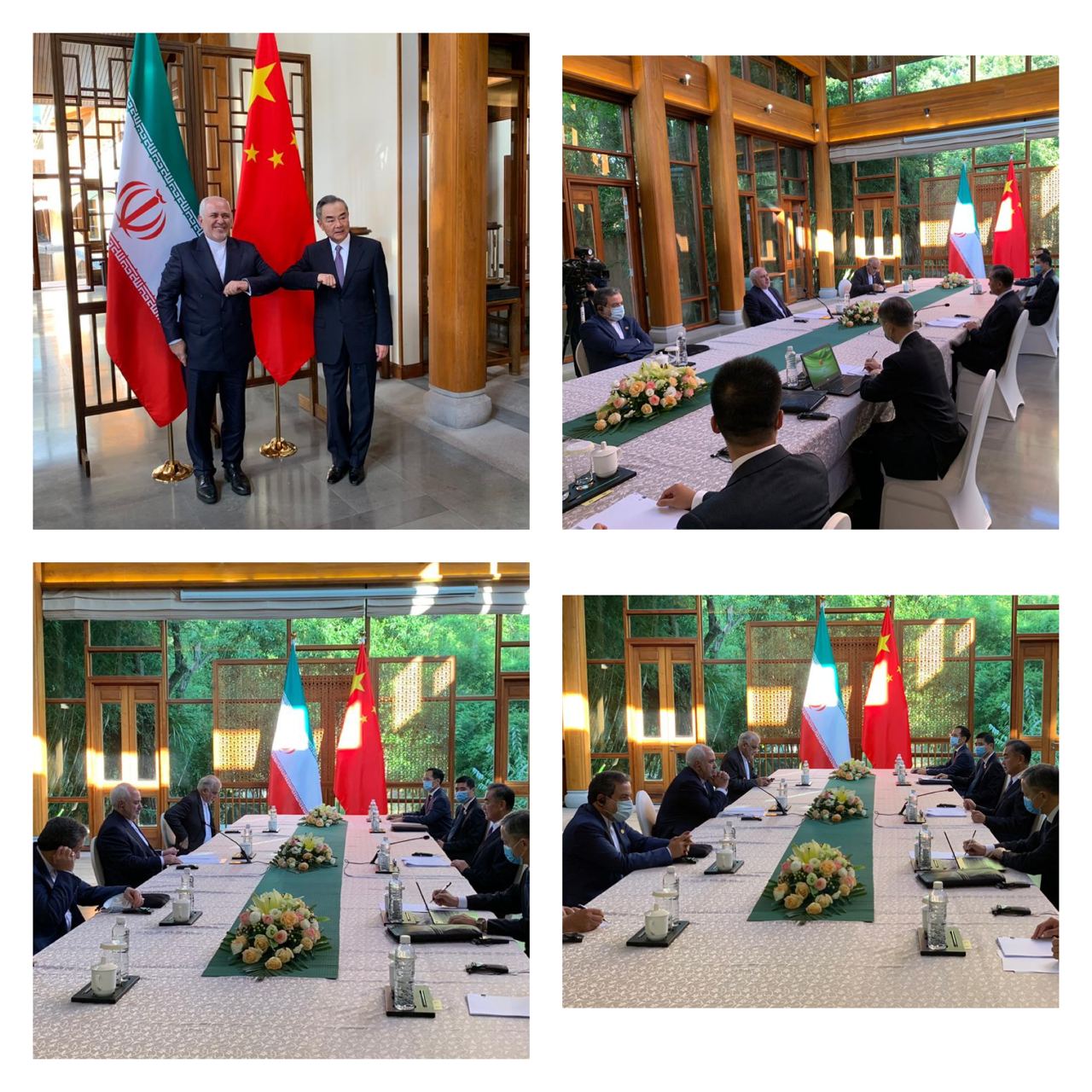

October 10: Iranian Foreign Minister Mohammad Javad Zarif met with his counterpart Wang Yi in Beijing. They discussed the 25-year comprehensive partnership, preserving the 2015 nuclear deal, collaborating on a COVID-19 vaccine and other issues of shared concern. The officials also condemned the United States for imposing sanctions on 18 major banks on October 8.

Fruitful talks in beautiful Tengchong with my friend Wang Yi on Iran-China Comprehensive Strategic Partnership.

— Javad Zarif (@JZarif) October 10, 2020

Rejected US unilateralism and US attempts to create unipolar world

Agreed on strengthening our ties incl 25-yr plan, regional coop, preserving JCPOA & vaccine collab.

2021

March 27: Iran and China signed a 25-year "strategic partnership" to deepen economic and security ties. The text of the agreement was not published, but a draft released in June 2020 indicated that Beijing would invest billions in exchange for a heavily discounted supply of Iranian oil. "We want China to continue to be a major trading partner to Iran and to have more cooperation in the field of joint ventures," President Hassan Rouhani said.

March 28: President Joe Biden told reporters that he had been “concerned” about the emerging partnership between Iran and China “for years.” On the next day, Ali Shamkhani, the secretary of Iran's Supreme National Security Council, said that Biden was right to be concerned.

The signing of 🇮🇷&🇨🇳Strategic Partnership Roadmap is part of the #ActiveResistance policy. The world isn't just the West & West isn't just the lawbreaking🇺🇸🇬🇧🇫🇷🇩🇪.

— علی شمخانی (@alishamkhani_ir) March 29, 2021

Biden's concern is correct: the flourishing of strategic cooperation in the East is accelerating the US decline.

April 13: Iran shipped more than half a million barrels of crude oil per day to China between November 2020 and March 2021, Reuters reported. The shipments accounted for 5 percent of China's oil imports.

August 10: A Chinese hacker group, UNC215, targeted Iranian computer systems, California-based cybersecurity firm FireEye reported. The objective of the hack was unknown, but UNC215 "targets data and organizations which are of great interest to Beijing's financial, diplomatic, and strategic objectives," FireEye said. The Chinese hacker group also targeted Israel, Saudi Arabia, Ukraine, Uzbekistan, Thailand, Kazakhstan and the United Arab Emirates.

UNC215 tried to disguise its activities by posing as Iranian hackers. "The use of Farsi strings, filepaths containing /Iran/, and web shells publicly associated with Iranian APT groups may have been intended to mislead analysts and suggest an attribution to Iran," FireEye said.

August 16: Chinese President Xi Jinping pledged that he would "enrich" the 25-year strategic partnership between China and Iran that was signed in March 2021. "Since the establishment of diplomatic ties half a century ago, the relations between China and Iran have developed steadily and the traditional friendship between the two countries has grown stronger with time," Xi said in a statement.

August 18: President Raisi sided with Beijing over its rejection of a second WHO probe into the origins of the coronavirus. "The politicization of the source of the COVID-19 pandemic is a serious threat to global health and is an example of some countries' efforts to isolate China," Raisi told Chinese President Xi Jinping in a phone call. Xi promised to do his "utmost to deliver the vaccine to Iran and help Iran overcome [the] coronavirus."

August 20: President Raisi told the National Coronavirus Task Force that Xi had promised to accelerate shipments of vaccines to Iran.

September 15: Iran signed an agreement to join the Shanghai Cooperation Organization (SCO). The SCO’s eight permanent members included China, Russia, India, Kazakhstan, Kyrgyzstan, Pakistan, Tajikistan, and Uzbekistan. The process to formally admit Iran as a full member was expected to take up to two years.

2022

December 13: Vice President Mohammad Mokhber met with Chinese Vice Premier Hu Chunhua in Tehran to discuss the 25-year comprehensive strategic partnership. The two men expressed their intentions to strengthen ties. Iran’s Foreign Ministry had expressed “deep discontent” with a statement issued by China and the Gulf Cooperation Council supporting a resolution to Iran’s territorial dispute with the United Arab Emirates over three islands. China had sent Vice Premier Chunhua to the United Arab Emirates and Iran to reinforce its commitment to both countries.

December 14: Finance Minister Ehsan Khandouzi announced 16 new memoranda of understanding with China as part of the 25-year comprehensive strategic partnership. The two countries signed deals in the energy, investment, banking, and infrastructure sectors. Finance Minister Ehsan Khandouzi announced 16 new memoranda of understanding with China as part of the 25-year partnership. The two countries signed deals in the energy, investment, banking, and infrastructure sectors.

2023

February 14: During President Ebrahim Raisi’s three-day state visit to Beijing, Iran and China signed 20 agreements—including on trade, transportation, information technology, tourism, agriculture, and crisis response—that could be worth billions of dollars. Amid rising tensions with Western powers, Iranian President Ebrahim Raisi and Chinese President Xi Jinping pledged to strengthen security and economic cooperation. China would invest in joint projects, including a high-speed rail system linking Tehran and Mashhad and improvements to Imam Khomeini Airport.

March 10: In Beijing, China brokered an agreement between Iran and Saudi Arabia to restore diplomatic ties seven years after severing relations. The regional rivals committed to reopening embassies in Tehran and Riyadh by May 2023.

March 15-19: Iran, China, and Russia conducted a joint naval drill in the Gulf of Oman. The drill, "Security Bond-2023," would "deepen practical cooperation between the participating countries' navies... and inject positive energy into regional peace and stability," the Chinese Defense Ministry said. The drill reportedly focused on non-combat activities such as search and rescue operations.

July 4: Iran was formally admitted as the ninth member of the Shanghai Cooperation Organization (SCO), a security and economic organization led by China and Russia, during an online summit hosted by India. President Ebrahim Raisi joined the proceedings with leaders from other member states, including India, Pakistan, Kazakhstan, the Kyrgyz Republic, Tajikistan, and Uzbekistan.

In a joint declaration, the SCO called for a “multi-polar world order” and rejected ideological blocs in world politics. The statement condemned the “unilateral and unlimited expansion of global missile defense systems” and stressed the need to “establish an inclusive government in Afghanistan with the participation of representatives of all ethnic, religious and political groups in Afghan society.” The SCO also proposed a 2030 Economic Development Strategy and endorsed China’s Belt and Road Initiative, although India opposed the latter move.

July 8: Tehran added Chinese to foreign language curriculum in Iranian schools. The schools could teach English, standard Chinese, Arabic, French, German, Italian, Russian, and Spanish.

July 31: Secretary of the Supreme National Security Council Ali Akbar Ahmadian met with Chinese Foreign Minister Wang Yi in South Africa to discuss ties and economic cooperation. The two discussed strengthening coordination under China’s Belt and Road Initiative on the sidelines of a meeting of the BRICS countries—Brazil, Russia, India, China, and South Africa. Wang also backed Iran’s sovereignty and national security.

July 31: Oil exports from Iran to China tripled between 2020 and 2023, according to Kpler, a firm that tracks international oil transfers. In 2020, Iran exported some 324,000 barrels per day (bpd) to China. Between January and July 2023, transfers reached roughly 1.1 million bpd.

Alex Yacoubian was a program assistant at the U.S. Institute of Peace, assembled this article. Connor Bradbury, a senior program assistant at the U.S. Institute of Peace, and Jordanna Yochai, a research assistant at the U.S. Institute of Peace, also contributed to this article.